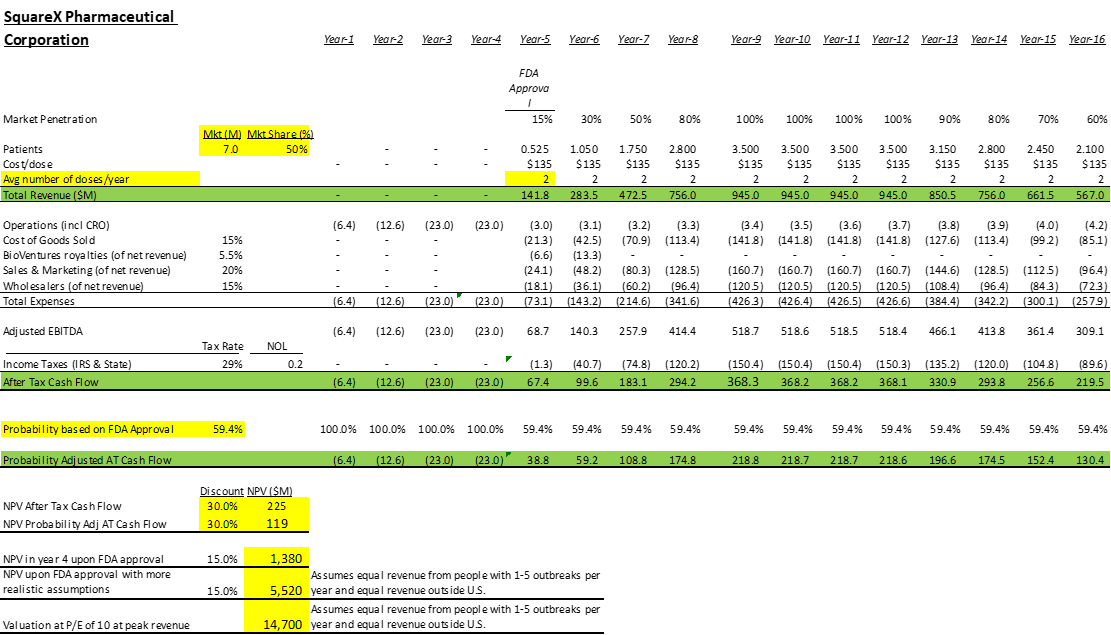

The valuation model following gives a Net Present Valuation of Squarex of $119 million using extremely conservative assumptions.

The key assumptions of the model are

- No sales outside U.S.

- No sales to persons with fewer than 6 cold sore episodes per year.

- Treating 50% of U.S. persons with 6 or more outbreaks.

- Sales of 2 doses per year on average to those persons instead of the recommended four doses.

- Four years to FDA approval. We think three years is feasible.

- 59.4% chance of FDA approval, which is the historical norm for drugs after Phase 2. In our case, the drug has been effective in 3 of 3 clinical trials with no serious adverse events, so we think the chance of FDA approval is actually higher than that.

- Discount rate of 30%. That is high. 25% would be more reasonable and would result in a higher valuation.

- $135 per dose. We conducted a survey of pharmacy benefit managers, and they all said they would approve reimbursing for this drug and the average reimbursement level was $135 per dose. We feel this is a conservative estimate, relatively low pricing for a prescription drug taken just four times per year.