SquareX Pharmaceutical Corporation Offering Stock to Qualified Investors at $3.00 per share $10,000 Minimum

Reasonable Projection of 100x Return on Investment (We know your B.S. detectors are going off, but we explain and justify the 100x return below)

Only drug that PREVENTS cold sores or oral herpes. Significant Efficacy in 3 of 3 Clinical Trials

Efficacy in 3 of 3 clinical trials: (read more)

Phase 1:

3 times longer time to next outbreak vs. placebo

Phase 2:

- 2.6 fold fewer outbreaks vs. placebo

- Significantly less severe outbreaks vs. placebo (0.3 vs. 1.3 on a 0-3 scale)

Mechanism of action trial:

- More immune cell proliferation to HSV-1

- Higher interferon gamma expression in presence of HSV-1

- Significant improvement in expression of 8 other immune genes in presence of HSV-1.

Advanced in clinical trial process

50 million Americans have at least one cold sore episode each year and 7 million have six episodes or more.

First in class and unique mechanism of action suggests likely efficacy against other diseases.

Patent protection to 2036 (read more)

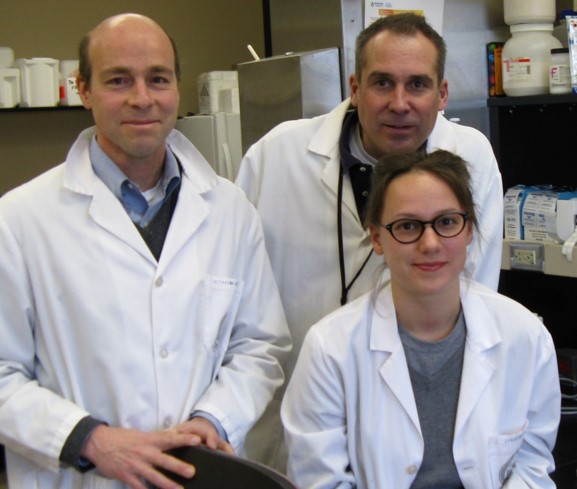

Qualified and experienced team:

The SquareX drug is just superior to Valtrex® (a billion dollar drug)

- Prevention is better than treatment

- More convenient dosing:

SQX770 can be taken any time between or during outbreaks and one dose works for 3 months. It is applied topically to the arm, not to the lip or lesion.

- Better efficacy:

And we think you should take this investment opportunity in SquareX.

- $3.00 per share = $22 Million valuation of company

- Net Present Value calculated as $119 Million now

even with these conservative assumptions:

- Only 2 doses per year instead of the recommended 4

- 30% discount rate

- 4 years to get FDA approval instead of 3

- No other indications besides cold sores

- Only 59.4% chance of FDA approval (the historical average for Phase 3 drugs)

- Valuation after FDA approval, about $5,500 Million (= 250x current stock price) (includes equal sales in persons with 1-5 outbreaks and equal sales outside U.S.)

- Valuation with P/E of 10 at peak market penetration = $14,700 Million (=670x current stock price) (includes equal sales in persons with 1-5 outbreaks and equal sales outside U.S.)

Another way to look at this: We have a better than 50% chance of receiving FDA approval. If we get approval, investors should receive at least a 20 to 1 return and potentially 100 to 1 or more.

If you invest, you are betting that we will get FDA approval.

The odds of that are better than 50%. Historically 59.4% of drugs entering Phase 3 trials get approval. We are not quite at Phase 3 trials, but with efficacy shown in 3 of 3 clinical trials and no serious adverse events to date, SquareX’s odds seem at least that good.

If you win that bet, your return is potentially 100 to 1 or greater. The return would appear it has to be at least 20 to 1 under any remotely reasonable sales projections.